According to NBR, if your income is above 3,00,000 taka annually or above, you will have to pay 5% TAX. But, it is BDT 3,50,000 for women and elderly persons over age 65. The tax-free income level for gazette liberation warriors injured in combat is BDT 4,75,000.

Every year the tax return submission starts on the 1st of July and ends on the 30th of November. If a person fails to do so, the person will have to pay 10% of the previous income or taka 1,000. It is wise to pay the tax on time.

In order to pay the taxes, you will need to know what documents are required for tax submission. With the proper documents in the right place, you can submit your taxes without any kind of hassle.

What Is An Income TAX Return?

An income tax return is a form provided by the TAX authorities. It usually contains income and expenses reports and some information about the taxpayer.

The tax return form allows anyone to calculate the tax liability, tax payment schedule, or refund the overpaid tax amount. Most countries fill up the tax return form annually.

A person must fill out the tax return form and submit it before the due date. If a person fails to deliver a tax return on the due date, he or she must face some penalties.

According to tax laws, Bangladesh’s due date is 30th June of the FY (fiscal year).

Read More: Tax Calculation In HR & Payroll Software

Incomes that Require an Income Tax Return in Bangladesh

- Any income from salaries security deposit interests

- House property earnings

- Agricultural earnings

- Business or professional earnings, firms (if applicable)

- Any income of the spouse or children of the taxpayer (if not a taxpayer)

- Capital gains

- Other income sources fall under income tax return if the amount reaches the designated threshold.

Incomes that are Exempted from Tax

- Allowances and benefits received by government employees

- Pensions

- The share of capital profit received by partners in a partnership firm

- Gratuity up to BDT 2.5 crore

- 50% income from the export business

- Amounts received under the Provident Fund Act, 1925

- Incomes that are brought into Bangladesh as per the law of foreign remittance

- Income from the zero-coupon bond, etc.

What is the Minimum Tax Amount in Bangladesh?

For people in the Dhaka and Chattogram city corporation regions, the minimum tax of Tk 5,000 will continue to be applicable if their taxable income surpasses the first slab (Tk 350,000).

The minimal tax amount for those residing in other city corporations is Tk 4,000.

It is Tk 3,000 for non-city corporation regions.

What Documents are Required for Tax Submission?

If you are willing to pay the taxes, you will need to have some documents ready. These documents are required to submit your tax to the NBR.

- A salary certificate

- A bank statement

- Rent Agreement and the bank statement

- Housing loan Statement

- Utility Bill or Land TAX

- Bank Statement of Business Income

- Financial Statement

- Capital Gain

- Certificate for interest on savings instruments

- Receipts of municipal tax & land revenue

- Other Sources of Income

1. A Salary Certificate From The HR

If the employer pays a person’s salary, he or she must collect a salary statement from the organization.

After the deduction of tax at source, the employee receives the net salary from HR. If there is any provident fund donation, that needs to be adjusted as well.

All the income from the organization will be mentioned in the salary statement. That means the basic salary, house rent, bonus, conveyance, or any other gain will be mentioned on the statement.

A salary certificate is usually provided by the payroll or the person responsible. There will be the HR’s and employee’s signatures at the time of receiving the statement.

2. A Bank Statement

According to the TAX law 1984, if the payment is above 20,000 taka and provided monthly. The payment must be made through the bank. When you receive your salary in the bank, there is proof of your actual amount.

It is proof of your salary count that is provided by the bank. This needs to be attached with the return form.

So a person will have to collect the bank statement from the respective bank.

3. Rent Agreement and The Bank Statement

You must submit the rental agreement if it is a case of house property. It works as proof that the tenant took an advance.

According to the TAX law, if the income from house property is more than 25,000 taka, the owner must deposit that via a bank account. The bank account and statement can be proof of the rental income for the fiscal year.

4. Housing Loan Statement

It is normal to take a loan for the building of a house construction. But this will also be counted as ‘income from house property”. A financial institution can also provide this kind of loan.

The income from house properties will reduce by the interest on housing loans. The interest paid on housing loans can be claimed as a return on income. In order to do that, a loan statement from a bank or a financial institution will require. The statement must be attached to the tax return form afterward.

5. Utility Bill or Land TAX

One of the deductible expenditures from rental income is Land lax and Utility Bills. You will need to provide all the expenditure-related documents. These documents will be proof of your payment.

In the case of living in the same house property, then the expenditure will be adjusted with the rental income.

For a separate meter, you will not need to do that. But if it is a common expenditure, you can claim it accordingly.

In any case, all the necessary documents must be collected and submitted with the tax return file.

6. Bank Statement of Business Income

Having a business is common for a lot of people. Typically a business person would use a bank to do all the business transactions.

How much profit a business person generates and how much he shows on a financial statement is essential. You can analyse both documents to cross-check this.

A business might have multiple bank accounts. In that case, it is necessary to show all the bank statements.

7. Financial Statement

All businesses keep a financial statement. In a financial statement, they record all the income expenses in detail.

Charted accountants will audit the financial statement of the organization. And verify the financial statement. After verification, this financial statement has bo attached to the return file.

8. Capital Gain

Capital gain is the amount gained on selling a fixed asset. You must look after those documents and submit them to NBR.

You need to submit a deed agreement, too, if your capital gain is from land or flat or car or house sales. The deed from these capital sales is also asked by the NBR.

9. Certificate for interest on savings instruments

A certificate for interest on savings instruments is a document detailing interest earned on savings instruments, like fixed deposits, savings accounts, or government savings bonds.

It is crucial for accurate income reporting in tax returns. Under TRP, taxpayers may need to submit such certificates and documents for income verification and tax regulation compliance.

10. Receipts of municipal tax & land revenue

Municipal tax receipts serve as proof of payment for property-related taxes and municipal charges where applicable.

Land revenue receipts confirm payment to the government for land use. These receipts are essential for record-keeping and compliance.

For accurate details, refer to local municipal authorities and land revenue offices.

11. Documentation for Tax Rebates

A tax rebate is a refund on taxes paid by an individual or a business. It is often provided by the government as an incentive or relief measure.

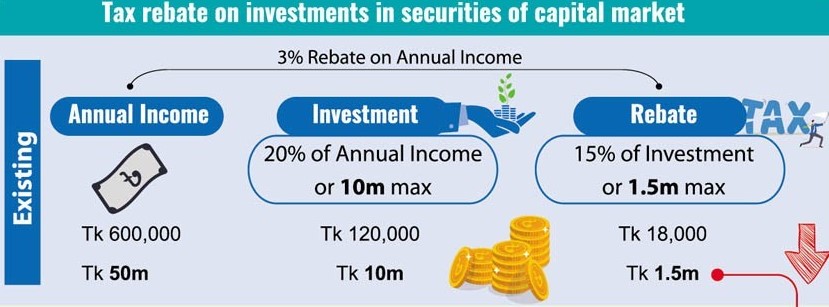

Currently, taxpayers can receive tax rebates by investing up to 20% of their taxable income or Tk 10 million, whichever is lower, in listed securities. The rebate is 15% of the investment, capped at 3% of their annual income.

Source: The Financial Express

12. Other Sources of Income

People nowadays have stocks and dividends; these investments get a tax rebate. However the interest income from these assets is taxable.

These gains from the assets could not be categorized on the above.

But these papers are also fundamental, according to NBR. Thus you will need to submit it.

Without the files mentioned above and documents, a person will be able to submit their tax.

How Can I Submit My Tax Return In Bangladesh?

Any taxpayer can get a free income tax return form from tax offices or the NBR website.

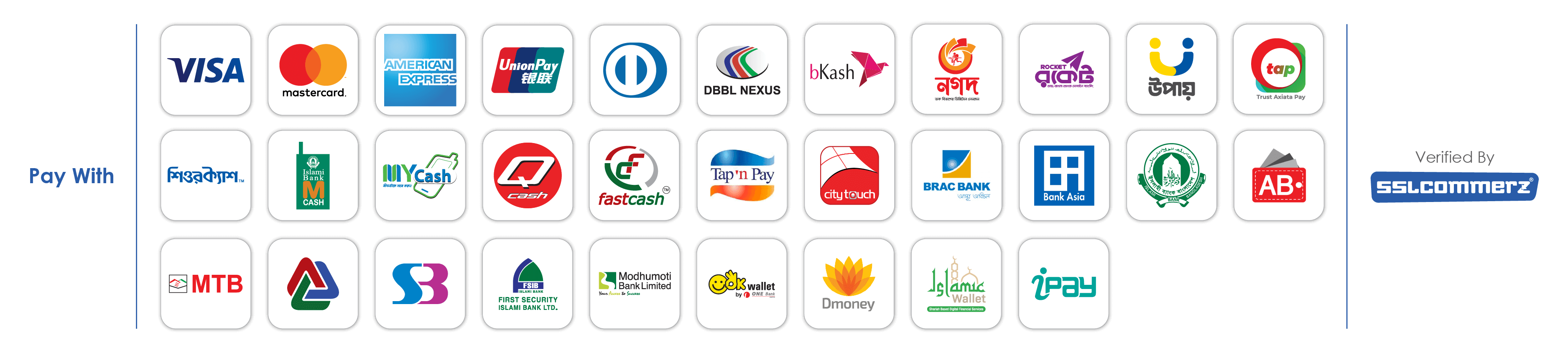

Following the assessment of income tax, each assessee is required to deposit the amount to the government exchequer via pay order, Treasury Challan, or online.

Subsequently, the appropriate tax circle will receive the fully signed and verified return form together with the required supporting documentation.

Check out the tips and tricks of the last time income tax return in Bangladesh.

To Sum Up

Tax is one of the largest income sources of government. So it is very much of a duty to pay tax regularly.

Tax law changes very often. At the same time, this is a complex process. A lot of people will not want to be involved in this complex procedure. So it is wise to leave the procedure to the experts.

Certainly, HR software can make a significant impact in this matter.

Contact us to get the best income tax calculation software in Bangladesh that can make your tax payment easier.