All the organizations need to adjust the TAX amount during the payment. The person responsible for payroll usually does the tax calculations.

According to the National board of revenue of Bangladesh, an employee with a 3,00,000 annual income will have to pay a 5% tax. This rate is for the following 1,00,000 amount of income. There are some exceptions. These exceptions are not for everyone. [ reference ]

Nowadays, many organizations prefer payroll software to do income tax calculations in Bangladesh. As a result, any employee does not have to calculate manually or adjust the tax liability. Any investments or amount change in income is automatically adjusted in the payroll software. For that reason, automated payroll software is a blessing for HR.

What is tax calculation?

Tax calculation is a calculation method used to determine how much tax a person will pay in a fiscal year.

Usually, tax is calculated by the specialized accountant certified for the respective work. But in modern times, multiple tools are available to us for tax calculation. Among them, some tools are free some are paid.

To determine tax, you need to calculate the adjusted annual income and then factor it in with the percentage. Calculating tax is best to leave in the expert’s hands as it is a crucial and complicated factor.

Tax Calculation and HR software

Everything is now being automated. HR software is also an automated system. Nowadays, HRIS has a built-in option for tax calculation. So the relationship between the process of income tax calculation and payroll software is vital.

Here are some similarities between tax calculation and a payroll software

- Both focus on a yearly income of an employee

- Both require precision

- They work with the employee information

- They are directly paying the government

- It is required to provide all the income sources of a person

- They both do critical mathematical functions

- Tax management system and payroll both work with the payment system in the organization

- They both have to follow a law

- They follow some rules and regulations provided by the authorities

Considering these similarities, a tax calculation system and payroll software can be merged together.

Importance of employee TAX calculation in an organization

The importance of individual employee tax calculation is vital for an organization. Here are some of the reasons for employee tax calculation.

Saves time for an HR

An HR has a lot of functions to work on in an organization. The more workload can be removed from the HR, the more time he gets to focus on other kinds of stuff. Introducing a tax management system can save a lot of time for payroll.

Makes the organization attractive

Making an organization attractive in terms of management can make a lot of difference. The chances of getting high-potential candidates increases. Sometimes they get a decent investor as well. Introducing a tax calculation system is a step towards making the organization modern. That makes that business attractive in many ways.

Error-free Tax Calculation

Tax calculation is a complicated process. That’s why it needs to be calculated with the experts. By calculating taxes by the experts, it becomes precise. But not every organization have a tax calculation expert. Thus HR software does all the tax calculations. As a result, error-free tax calculation is critical to the organization.

Automated tax feature

Every software with a tax calculation feature automatically does all the tax-related work. Whenever the government changes the tax law, the software automatically updates the rules according to the adjustments. While providing the salary to the employees, the tax is adjusted by the rules of government policies. Having this feature certainly helps an organization massively.

Removes the burden of an employee

A tax management system is undoubtedly a stress relief for an employee. They do not have to rate the hassle of tax calculating authorities and making extra payments. The organization will be doing the tax calculation and tax payment with the help of the payroll software.

Increases employee satisfaction

Employee satisfaction can boost the productivity of an individual by a large margin. One of the goals of an organization is increasing employee satisfaction because the satisfaction will keep the employee engaged at work and more productive. By providing the benefit of tax payment, they will be satisfied, and productivity will improve.

Organizational growth for long term

Software with a tax calculation feature will help the organization grow long-term. The software with this feature will save employees time and make them more productive. The organization may get some big investors if the management looks appealing.

Things to look at before choosing HR software for tax calculation

There is a lot of tax software available in Bangladesh. Not all of them are worthy of selection. Every country has there own tax calculation system. Bangladesh also has its own tax management system. Here are some features of income tax calculation in Bangladesh.

- The software must be capable of working with employee data

- The software must be accurate in the calculation

- The security level must be strong at its core

- There should be transparency

- Nothing should be accessible to someone without authoritative permission

- The tax management system must work fast

- There should not be any delay in outputs

- The employer information should be stored and be able to update when necessary

After considering those factors, a tax management system should be reliable for any kind of organizational use. These features are strongly related to the tax calculation.

Recommendations

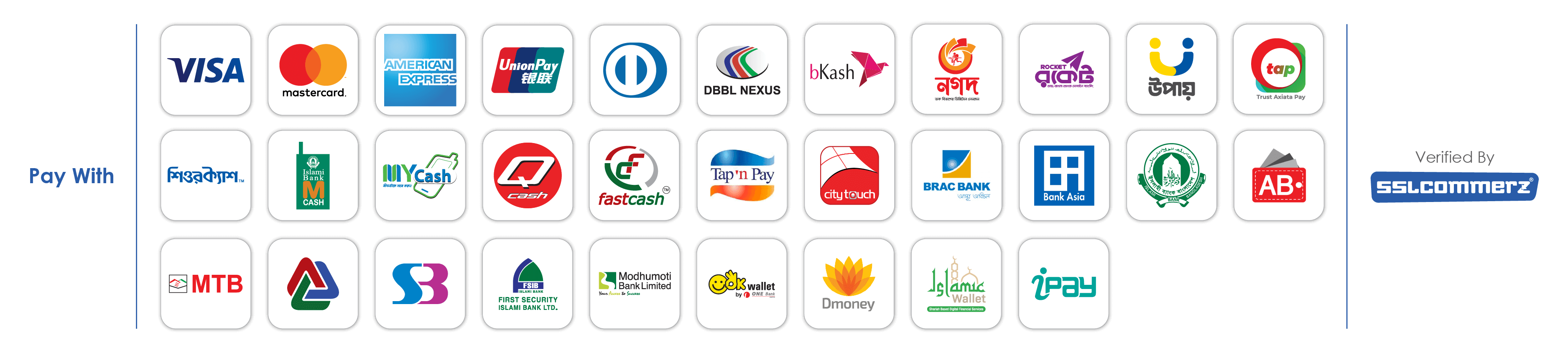

Everybody wants to be with the best option available to them. In Bangladesh, there is a lot of software to choose from. But PiHR is trusted and chosen by more than 300 companies in Bangladesh.

Some reasons to choose PiHR for the tax calculation payroll software:

- Results are pinpoint and accurate

- Works with every data needed to calculate TAX

- Trusted by a lot of organizations

- Easy and user friendly

- Has 24/7 support

- The security is rock solid

Summary

Tax calculation is one of the most essential functions of a business. It is also important to make every financial transaction precise. The details discussed above can help you to know about tax calculation in an organization with Payroll software. Without a tax calculation feature, payroll software can be a burden. To remove the burden of an HR as well as employees, it is highly recommended to choose PiHR.